|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Refinance Home Loan Bankruptcy: Understanding Your Options and What to ExpectFiling for bankruptcy can be a challenging time, especially when it involves your home loan. Many homeowners wonder if refinancing their home loan after bankruptcy is possible, and what options are available. This article will guide you through the process, providing valuable insights into refinancing your home loan post-bankruptcy. Understanding Bankruptcy and Its Impact on RefinancingBankruptcy can significantly impact your financial standing and your ability to refinance. It's essential to understand how bankruptcy affects your credit and refinancing options. Types of BankruptcyThere are two main types of bankruptcy filings for individuals: Chapter 7 and Chapter 13. Each has different implications for your financial future and refinancing eligibility.

Impact on Credit ScoreBoth types of bankruptcy can lower your credit score, affecting your ability to refinance immediately. However, with time and financial discipline, you can rebuild your credit score to qualify for refinancing options. Steps to Refinance After BankruptcyRefinancing a home loan after bankruptcy requires careful planning and timing. Here's what you need to know: Rebuilding Your Credit

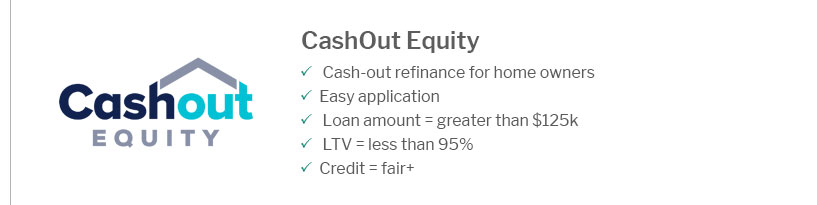

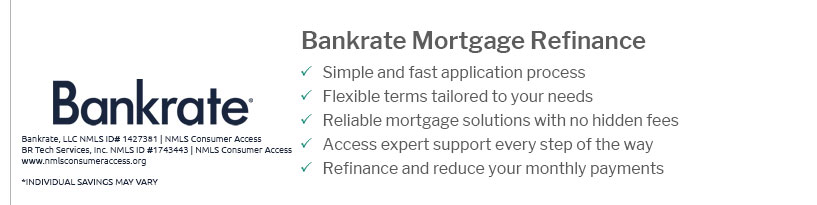

Waiting PeriodsDifferent lenders have different waiting periods post-bankruptcy. Generally, you may need to wait 2-4 years after a Chapter 7 bankruptcy and 1-2 years after a Chapter 13 discharge before you can refinance. Consider exploring cash out refinance options to leverage your home equity once you become eligible. Choosing the Right Refinancing OptionOnce eligible, it's crucial to choose the right refinancing option that suits your financial situation. Types of Refinance Loans

For those considering shorter loan terms, check current home refinance rates 15 year fixed to see if they align with your financial goals. FAQ: Refinancing Post-Bankruptcy

Understanding your refinancing options post-bankruptcy can help you make informed financial decisions and regain control of your financial future. https://hansonattorney.com/blog/loans/can-i-refinance-my-home-while-in-chapter-13-bankruptcy

The good news is that it is possible to refinance your mortgage loan while in an active bankruptcy. However, you will need to seek the court's approval before ... https://www.peoplesbankmtg.com/news/how-to-refinance-your-home-after-bankruptcy/

You could be eligible for refinancing as soon as one day after the discharge of your from your bankruptcy plan. This will depend on the reason ... https://www.tommcbridelaw.com/blog/when-can-i-refinance-my-mortgage-in-chapter-13-bankruptcy/

Going through Chapter 13 bankruptcy may seem to close off financial options such as refinancing your home mortgage.

|

|---|